Communicated Content – A rapid decline in value has been observed in Bitcoin prices as a result of the market’s contraction, a situation that is mainly caused by the current market conditions and many other political and economic causes such as, recession.

1. Bitcoin’s decrease in value and the current context

The downward trend has significantly reduced the value of BTC, as well as XBT (read more about BTC vs XBT). Although there are theories about how it will improve, the cryptocurrency market remains unpredictable.

As the turmoil grew owing to shifting circumstances, the value of cryptocurrencies fluctuated severely on the global market. This scenario continues to mostly affect Bitcoin, whose value has been steadily declining since March 2022.

Political decisions that disregard the cryptocurrency market have made the bad situation worse. While Eastern Europe is still in a state of unrest, China still has many ongoing troubles regarding different aspects of its country. These combined effects on the world economy have affected the value of Bitcoin and the future support level for it is not guaranteed. At the same time, some detractors believe that BTC will once again plummet to zero. Since BTC has a solid foundation, most of these worries are based on fear and uncertainty.

Nonetheless, there are expectations that the current winter will bring stability, helping the market purge itself of weak and useless projects.

2. The first news that heavily affected Bitcoin in 2022

The global cryptocurrency market has been in decline for a very long time. Compared to past times, it has taken longer than anticipated. Although the crypto winter in 2017–18 already lasted for more than a year, the recent earthquake is of enormous consequence. In addition, this period has caused significant losses.

When the Russian aggression against Ukraine intensified in March 2022, it started to impact the economy as a whole. Sanctions were imposed on the Russian Federation and as a result of the reforms, the amount of capital entering the markets has decreased significantly, heavily affecting BTC. Its value was at $47K at the time when it attempted to regain positive territories but failed. It dropped further, reaching $35K, which remained an essential range for its stability.

The decline to $30K took some time, however, it wasn’t stable and the market experienced a free-fall situation. Bitcoin quickly dropped to $20K, and the losses persisted, reaching a minimum price of $18K. Then the market took another big hit when FTX became insolvent, an event that shook the whole market knowing that FTX was worldwide the second biggest exchange, bringing the price of Bitcoin to $16K, something we haven’t seen since November 2020.

3. What do people think about Bitcoin?

Bitcoin is frequently purchased as a medium or long-term investment strategy. Some choose to purchase it at a discount in expectation of a future price increase to sell it after it happens. Others purchase Bitcoin with the aim of hanging onto it for a long time, despite potential price drops and increases, mainly because they believe in the future price of Bitcoin and the potential it has on so many layers.

Some visionary people and crypto fans think that Bitcoin or another cryptocurrency will eventually replace fiat money, which happened in El Salvador when they adopted Bitcoin as a legal tender in 2021. These cryptocurrency advocates frequently think that decentralization is the way of the future and that centralized banking is unfair or hazardous. Such a person’s purchase of Bitcoin is more than just an investment. It reflects their enthusiasm for cryptocurrencies and also how they consider the current way we do finance.

This isn’t the first time that Bitcoin has crashed by more than 50% from its all-time high. It has already happened in the past, four times to be exact. The adoption Bitcoin gained through its history has proven that it is seen as a reliable store of value, and this argument was strengthened when institutional and retail funds joined the game, bringing with them huge investments into Bitcoin’s ecosystem.

4. Can Bitcoin’s price go to zero?

As we saw above, Bitcoin has a big community base that has the biggest role to play in maintaining this cryptocurrency alive, but you may be asking yourself, how can they do that? A good question.

Big players in the crypto industry, such as investment funds or crypto whales, can heavily influence the price of a given cryptocurrency. These entities or individuals own a consequent amount of Bitcoin’s total supply, which allows them to manipulate the markets. This is a double-edged sword that is mainly bad for smaller investors knowing that market manipulations are unpredictable, but can be beneficial as these crypto whales can prevent the price of Bitcoin go to zero.

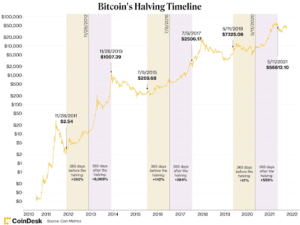

Moreover, there are other important factors to take into account. Bitcoin’s maximum supply is set to be 21 million coins, of which 19.2 million are already in circulation. What this means is that the maximum supply of Bitcoin is limited, making it a scarce asset, which following the basic laws of supply and demand will cause the price of Bitcoin to inevitably surge in the near future. In addition to what we said, if you don’t already know, Bitcoin’s block reward, which stands for the amount of Bitcoin you are rewarded as a miner when you add a new block to the blockchain, is halved every four years. Now look at what happened historically before and after this halving event occurred:

As you may see, before the halving event happens, Bitcoin’s price witnesses a rally pulling with it the whole market, as many other cryptocurrencies’ prices are tightly correlated with Bitcoin’s price. The halving events have this much impact on the Bitcoin price, mainly because reducing the miners’ reward decreases the inflow of new Bitcoin into the market, increasing its scarcity and making it harder for miners to mine Bitcoin.

5. Final thoughts

Without a doubt, the crypto industry would suffer irreparable damage if the price of Bitcoin dropped to zero. However, there is very little probability that Bitcoin’s price will plummet in this manner. Even if there are several things that could make Bitcoin less valuable over time, it would take some major legislative and economic changes, not to mention the dissolution of the Bitcoin network, for Bitcoin’s value to drop to zero quickly.

There are many big players in the crypto industry who will do their maximum to save Bitcoin or it may also significate their respective ending otherwise, as Bitcoin is the main driver of the cryptocurrency markets. We personally think that Bitcoin has big potential as digital gold, giving it an ever-lasting use case as the backup fund of any project that humans can think of. LFG!