Mobile Sports Betting App Discussed

COMMUNICATED CONTENT – There are plenty of reasons to love New York but online sports betting is certainly not one of them because it doesn’t exist…at least not now. The only outlet for sports bettors who want to wager within the state’s borders comes in the form of brick and mortar casinos with sportsbooks attached.

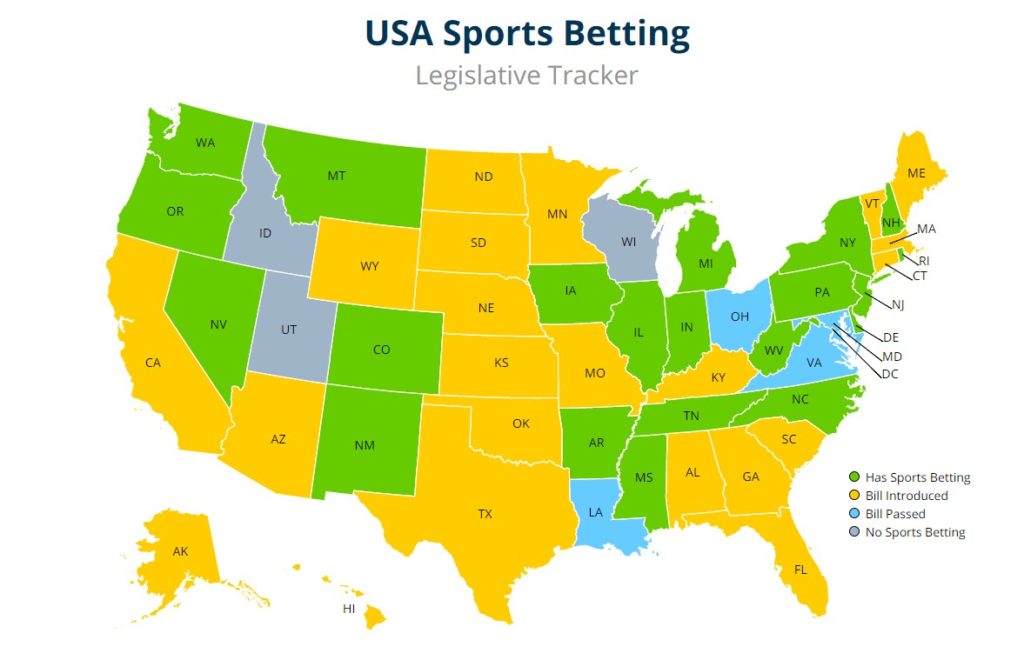

And while New York’s next-door neighbor was the driving force to legally challenge the Professional and Amateur Sports Protection Act of 1992, aka PASPA, ultimately getting it struck down by the courts and paving the way for legal sports betting in the United States, New York has sat idly by without a lifting a finger to reap the benefits of all that online betting revenue.

“2019 was a landmark year because it was the first full year where legal sports betting was available in the state of New Jersey,” said Yaniv Sherman, head of commercial development for 888 Holdings, in a statement.

“The state-led the pack in legalizing sports betting and the results speak for themselves. The market has consistently grown throughout the year, along with a record-breaking November and December during which almost half a billion dollars were wagered. This is resulting in significant tax income for the state, as well as a healthy, competitive, and safe landscape for players and operators alike.”

However, that could soon change as sports gaming brought more than $4 billion to New Jersey in 2019 and some of that was generated by New Yorkers crossing the bridge into the Garden State and betting on their mobile devices within New Jersey’s boundaries. New York wants their piece and it’s about time.

Senador Joe Addabbo Jr. has drafted Bill S17D which would allow for legal mobile sports betting platforms in the state. As it stands now, only a single skin or provider would be allowed but the hope is that more operators would be welcomed in to offer competing services leading to a better overall product in the marketplace.

There is currently the state maximum of seven land-based casinos that were greenlighted in 2019 but the mobile applications were deemed a violation of the constitution of New York.

But Senator Addabbo Jr. addressed this concern, “At first, the question was of the constitutionality of mobile sports betting in our state. But I think we’ve gone beyond the constitutionality issue because once you put the server that actually accepts the wager on the land of the licensed casino, you satisfy our constitutionality issue as well as the intent of the constitution.”

“Right now, our estimates are anywhere from $160 to $200 million and that’s for this year between the licensing, fees, and the taxes,” said Addabbo.

New York legislators continue to drag their feet on this and nearly all online sports betting regulation and sports betting sites but there is a global pandemic wreaking havoc with the economy and if the Empire State legislators are smart, they will pick up the torch and get online betting on the books sooner rather than later.

Tax Revenue Bonanza

Speaking of Bill S17D, the projected numbers are staggering in that it proposes a 12 percent state tax on mobile sports betting revenue, while a one-time $12 million licensing fee paid by each operator would be levied. Projections are that those products could reap $900 million in annual revenue or more.

“New York has a chance to become the biggest mobile sports betting hub in the US,” said Geoff Fisk, an analyst for NY Sports Day. “New Jersey holds that position right now, and some of that comes from New York bettors traveling to New Jersey to place a legal wager.”

“If New York legalizes online sports betting, the revenue that’s going to New Jersey stays in New York. Considering tourism and state population, New York could host the most lucrative mobile sports betting industry in the country.”

“All seven New York casinos have sportsbook partnerships in place, so those seven brands are locked in if online sports betting gets the green light,” Fisk said. “DraftKings and FanDuel already have a place in the New York market.”

“Expanding to two or more skins per operator, however, could include brands like Barstool and PointsBet. The sports betting market would thrive with 14 or more brands in competition.”